Get an LLC: How Much To Form LLC. Business names, create an LLC, Business registration

& Company registration numbers. Easy Setup! Fast turn around time!

How to get an LLC – How Much To Form LLC

To create an LLC, you will require to adhere to these actions:

Select a name for your LLC that is not already in use by another business and is certified with your state’s naming regulations. How much to form LLC.

File articles of organization with your state’s LLC declaring workplace. This paper formally produces your LLC and also consists of information such as the name and also address of the LLC, the names and addresses of the participants, and also the objective of the LLC.

Acquire any kind of essential licenses and also allows for your business.

create an operating arrangement, which describes the management as well as economic framework of the LLC.

Pay any kind of required costs to the state for registering your LLC.

Note: How much to form LLC. The procedure for developing an LLC will certainly differ depending upon the state where you want to create it. It is advised to seek advice from a attorney or an accountant who can assist you on the details regulations as well as guidelines of your state.

Exactly how to obtain a business license

Establish the type of business license you require: Depending on the sort of business you prepare to operate, you may need a particular kind of license. If you intend to market alcohol, you will certainly need a liquor license.

Research local and state demands: Each state and district has its own collection of regulations and also policies for getting a business license. How much to form LLC. You’ll need to research the certain requirements for your area to ensure you have all the necessary documents as well as documentation.

Collect called for documents: You will require to provide particular records, such as proof of your business name as well as address, tax identification number, and also proof of insurance coverage. Ensure you have all of these records prior to applying for your license.

Get your license: Once you have all the required papers, you can look for your business license by submitting the suitable documentation to your neighborhood or state government firm. This can be done online, by mail, or personally.

Pay the required charge: How much to form LLC. You will certainly require to pay a charge to get your business license. The charge amount varies depending upon your place and the kind of business you are operating.

Wait for authorization: After you have actually sent your application and paid the needed charge, you will need to wait on your license to be authorized. The authorization process can take numerous weeks, so be patient.

Keep your license updated: How much to form LLC. Once you have your business license, you will need to maintain it updated by restoring it each year or as called for by your local or state government.

How to find up with a business name – How Much To Form LLC

Start by brainstorming search phrases that relate to your business. How much to form LLC. These can include the products or services you use, the target audience, or any distinct attributes of your business.

Consider the character or tone you desire your business name to communicate. Do you want a name that is severe and also specialist, or something much more enjoyable as well as catchy?

Take into consideration using a mix of words that are relevant to your business. This can consist of industry-specific terms, or words that reflect your firm’s worths or objective.

Play around with various word mixes and see what appears excellent. You can also make use of a business name generator device to aid you generate ideas.

Examine the availability of your selected name by looking online and also inspecting if the domain is offered.

Get responses from good friends, family, and coworkers to see if they such as the name and also if it communicates the ideal message.

When you’ve chosen a name, ensure to register it with the proper government company and also secure the required trademarks as well as copyrights to shield your business name.

Just how to create an LLC

Select a one-of-a-kind name for your LLC: Your LLC name must be appreciable from various other business names on documents with your state’s LLC filing workplace.

Select a signed up Agent: How much to form LLC. A registered Agent is a individual or business entity that will accept lawful files in behalf of your LLC.

Submit articles of organization: This is the paper that officially develops your LLC and has to be submitted with your state’s LLC declaring office.

Acquire any needed licenses and licenses: Depending on your business kind and location, you may require to obtain extra licenses and also permits.

create an operating contract: An operating contract is a lawful record that lays out the ownership as well as monitoring framework of your LLC.

Get an EIN: An EIN, or Company Identification Number, is a unique number appointed to your business by the internal revenue service for tax functions.

Register for state taxes: Depending upon your state, you might need to register for state tax obligations, such as sales tax obligation or payroll tax obligations.

Follow continuous conformity needs: LLCs go through continuous conformity demands such as annual reports and franchise business tax obligations.

Open up a business bank account: Open up a business savings account to maintain your individual and also business finances different.

How much to form LLC. Submit annual reports and also taxes: LLCs are required to file annual reports as well as tax obligations, contact your state for certain demands.

New Jersey business registration – How Much To Form LLC

In order to register a business in New Jersey, the complying with steps need to be finished:

Choose a business name: How much to form LLC. The business name have to be unique and also not already being used by an additional business. The name can be checked for schedule with the New Jersey Division of Revenue and Venture Providers.

Register for taxes: How much to form LLC. All companies in New Jersey are called for to register for state tax obligations, consisting of sales tax, company withholding tax obligation, and unemployment tax. This can be done via the New Jersey Division of Revenue as well as Business Services.

Acquire any type of required licenses or permits: Depending upon the sort of business, specific licenses or authorizations may be called for. How much to form LLC. This includes licenses for sure professions, such as doctor or building service providers, in addition to permits for sure activities, such as food solution or alcohol sales.

Register for a business entity: Services in New Jersey can pick from numerous various sorts of lawful structures, such as sole proprietorship, partnership, restricted liability company (LLC), or company. How much to form LLC. The suitable structure needs to be chosen based on the certain requirements of business.

File articles of unification (if suitable): If business is a corporation, articles of consolidation must be submitted with the New Jersey Division of Revenue as well as Enterprise Providers. This procedure includes submitting a certificate of unification and paying a cost.

Register for staff member withholding taxes: How much to form LLC. Services with staff members must register with the New Jersey Division of Revenue and Business Services to report and also pay worker withholding tax obligations.

Obtain any type of essential insurance: How much to form LLC. Depending upon the type of business, specific kinds of insurance may be called for, such as employees’ payment insurance.

Once every one of these actions have actually been completed, the business will be officially registered and able to run in New Jersey. It is important to note that continuous compliance with state legislations as well as laws is additionally called for to preserve enrollment.

What is a business in a box? How Much To Form LLC

A business in a box is a pre-packaged set of sources, tools, and also products that are developed to assist business owners quickly and also conveniently begin and also run their very own business. How much to form LLC. Some instances of business in a box consist of franchises, online services, and home-based organizations.

How To Register business name

Select a special business name: Before registering your business name, see to it it is special as well as not currently in operation by an additional business. You can use a business name search device to examine if the name is available.

Figure out the sort of business entity: Choose the kind of business entity you wish to register as, such as a sole proprietorship, collaboration, LLC, or firm.

Register with the state: Most states need organizations to register with the state government. How much to form LLC. This can normally be done online or in person at the appropriate federal government company.

Acquire any necessary licenses as well as licenses: Relying on the kind of business you are operating, you might need to acquire specific licenses and licenses. These can differ by state as well as industry, so it is very important to study what is required for your business.

Register for taxes: Register for any kind of required state and government taxes, such as sales tax and also earnings tax obligation.

File for a DBA Doing Business As if necessary: If you’re operating under a name that’s different from your legal name, you’ll require to file for a DBA.

Maintain documents: Keep all enrollment papers, licenses as well as permits in a safe place for future reference.

What is a Business enrollment number? How Much To Form LLC

A firm enrollment number, additionally referred to as a business registration number or business registration number, is a unique identification number appointed to a business by a federal government firm. How much to form LLC. This number is made use of to determine the company for legal and also management purposes, such as filing taxes, opening checking account, and conducting business transactions. The style and place of the enrollment number might differ depending on the country or state in which the firm is registered.

Northwest Registered Agent

Northwest Registered Agent is a company that provides signed up Agent solutions to businesses in the United States. They work as the official point of contact for a business, receiving and forwarding lawful files, such as service of process and also annual reports. How much to form LLC. They likewise aid businesses stay certified with state regulations by giving tips for crucial filings and also due dates. Northwest Registered Agent has stayed in business because 1998 and also is headquartered in Washington state. They currently serve over 250,000 companies throughout the nation.

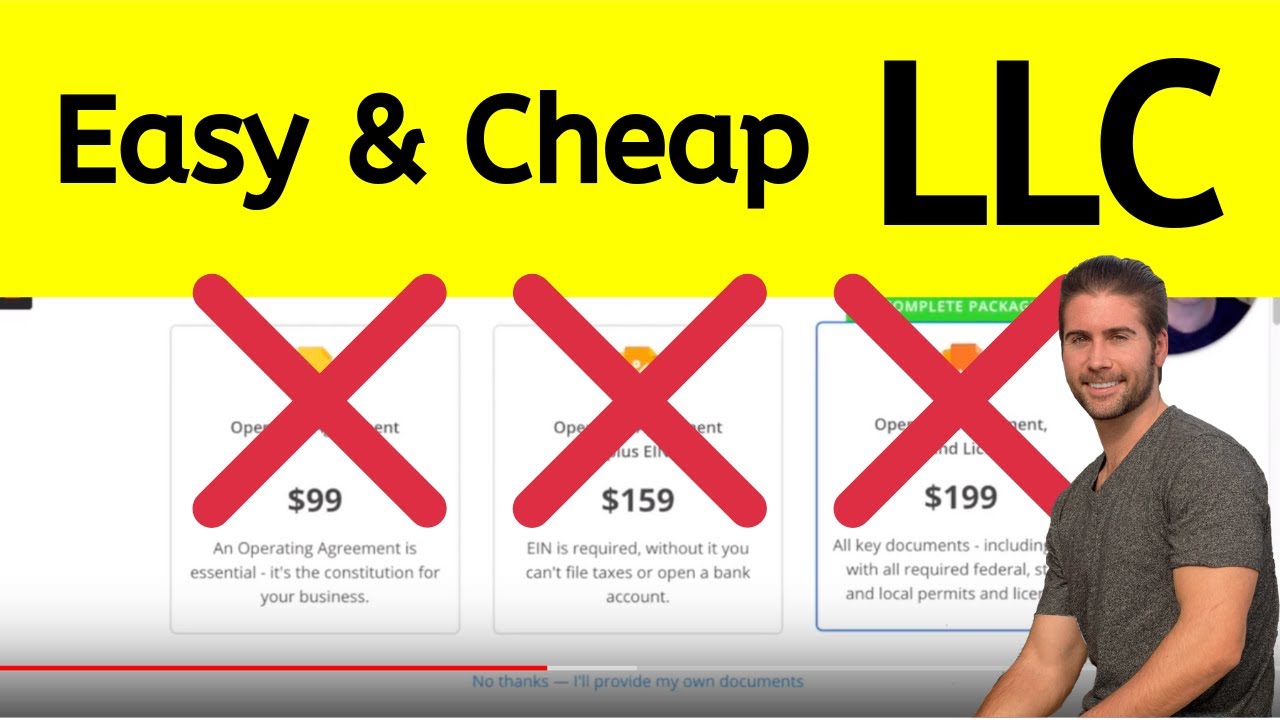

Incfile

Incfile is a business that gives business formation services, consisting of LLC formation, company formation, as well as not-for-profit formation. They also supply services such as registered Agent solution, compliance solutions, as well as business document declaring. Incfile aims to make the process of starting and maintaining a business as straightforward as well as economical as feasible for their customers. They have a straightforward web site as well as provide detailed advice throughout the procedure. Furthermore, Incfile supplies a contentment guarantee and a 100% money-back guarantee for their services.

What is Inc Authority? How Much To Form LLC

Inc Authority is a company that provides legal, tax, and compliance solutions for businesses. How much to form LLC. They aid entrepreneurs and also small business owners include their organizations, handle their legal and tax commitments, as well as ensure that they are in conformity with all relevant legislations as well as regulations. Their solutions include company formation, registered Agent services, hallmark registration, business license as well as allow help, and more.

Zenbusiness

Zenbusiness is a business that uses business formation and also assistance services to business owners and also small company proprietors. They supply help with setting up a brand-new business, including choosing a business structure, obtaining required licenses as well as permits, and also registering with state and also federal companies. How much to form LLC. They also offer continuous assistance services such as bookkeeping, tax obligation prep work, as well as signed up Agent services. Their objective is to simplify the process of beginning and also running a business, so entrepreneurs can concentrate on expanding their business and attaining their goals.

Swyft Filings

Swyft Filings is a US-based on-line legal service that supplies an cost effective and simple method for organizations to incorporate or create an LLC (Limited Responsibility Business). How much to form LLC. They provide a range of solutions consisting of business enrollment, trademark declaring, as well as annual report solutions. Swyft Filings is understood for their straightforward internet site as well as their dedication to offering a fast as well as efficient solution. They likewise use a 100% complete satisfaction guarantee and a virtual authorized Agent service.